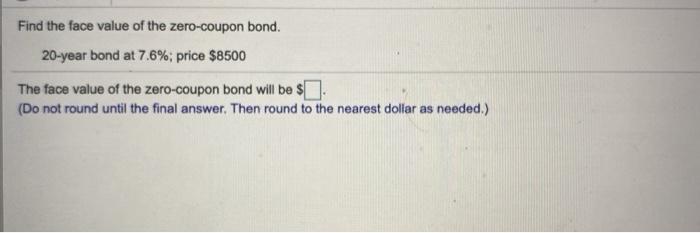

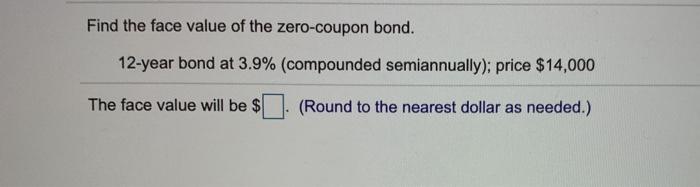

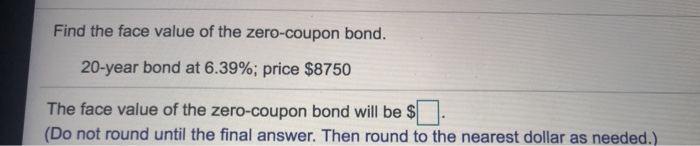

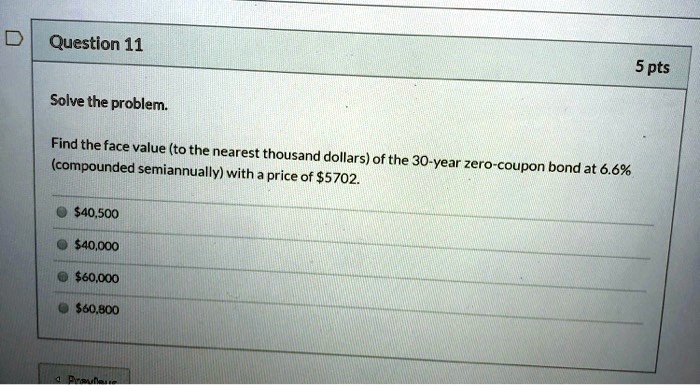

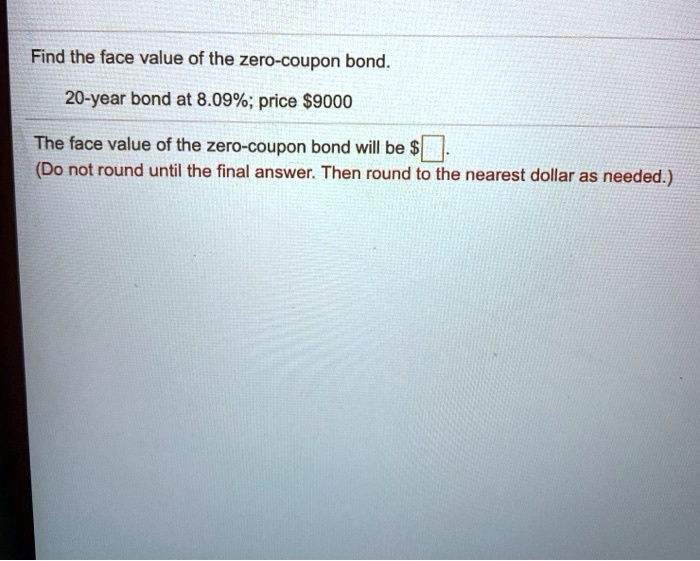

44 find the face value of the zero coupon bond

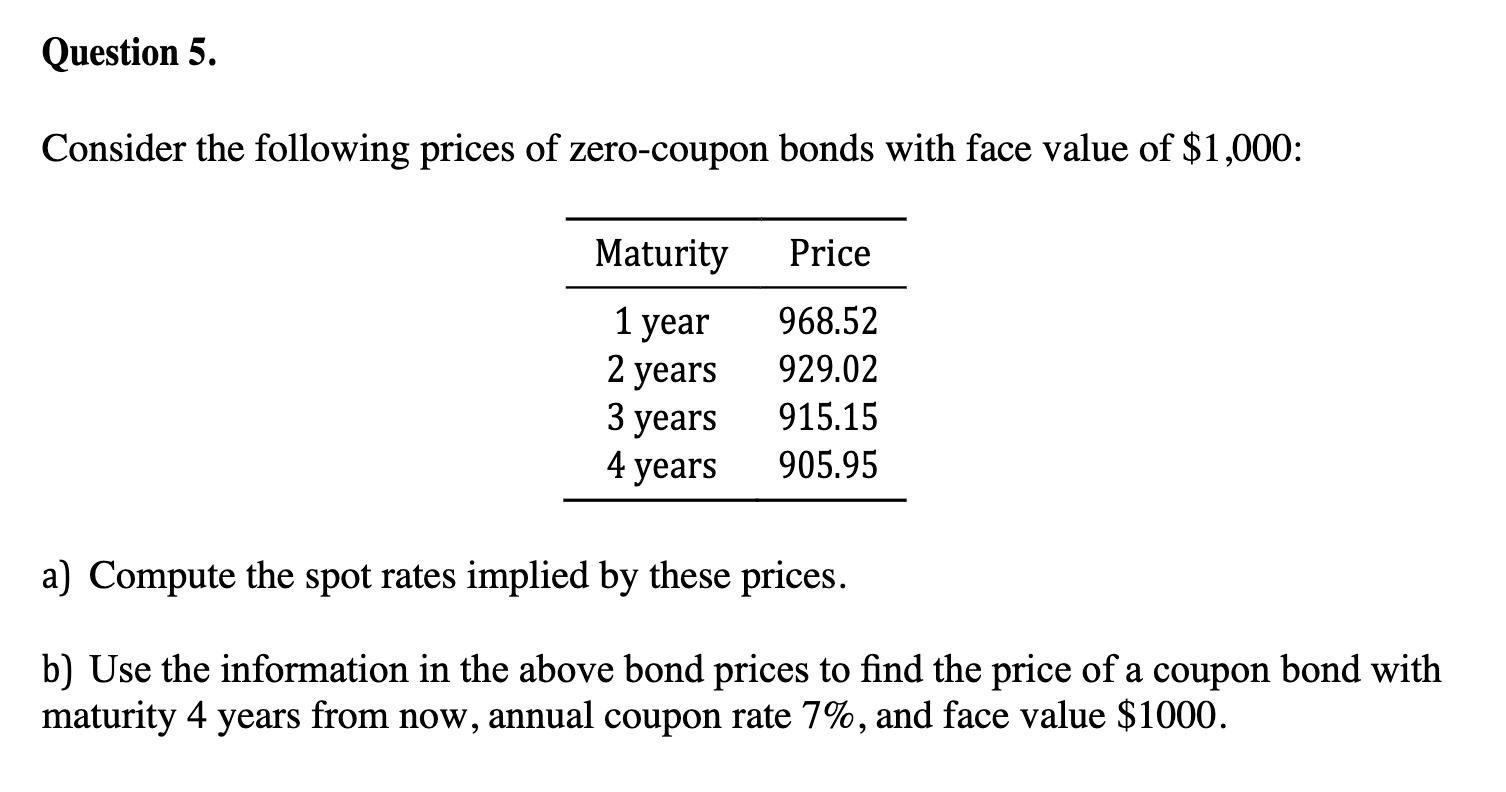

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Bond duration - Wikipedia Consider a bond with a $1000 face value, 5% coupon rate and 6.5% annual yield, with maturity in 5 years. The steps to compute duration are the following: 1. Estimate the bond value The coupons will be $50 in years 1, 2, 3 and 4. Then, on year 5, the bond will pay coupon and principal, for a total of $1050.

The San Diego Union-Tribune - San Diego, California ... Nov 01, 2022 · The nearly 100-year-old building has fallen into extreme disrepair and its owner was ordered to clean up and secure the site.

Find the face value of the zero coupon bond

Home | NextAdvisor with TIME The I Bond Rate Just Fell Below 7%. We Answer Your Questions 7 min read. 4 Ways the Fed’s Interest Rate Hikes Directly Affect Your Money — and What You Can Do About It 9 min read. News and Insights | Nasdaq Oct 07, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

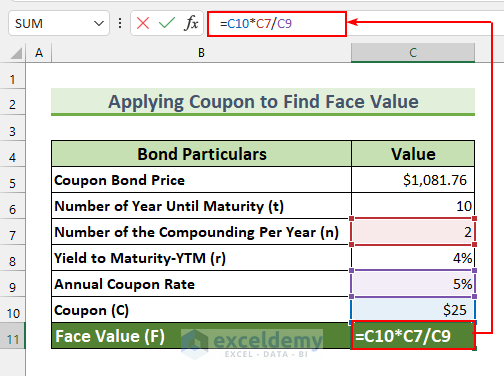

Find the face value of the zero coupon bond. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73. How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) News and Insights | Nasdaq Oct 07, 2022 · Get the latest news and analysis in the stock market today, including national and world stock market news, business news, financial news and more Home | NextAdvisor with TIME The I Bond Rate Just Fell Below 7%. We Answer Your Questions 7 min read. 4 Ways the Fed’s Interest Rate Hikes Directly Affect Your Money — and What You Can Do About It 9 min read.

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "44 find the face value of the zero coupon bond"