41 zero coupon bond benefits

What is a Zero Coupon Bond? Who Should Invest? | Scripbox Following are the advantages of zero coupon bonds Significant returns on maturity These bonds are deep discount bonds that offer significant returns on maturity. Additionally, a bondholder can exit the bond by selling in the secondary market (stock market), in case the interest rates decline sharply. Fixed interest Zero Coupon Bond -Features, benefits, drawbacks, taxability ... - Fisdom Zero coupon bonds come with several benefits. The biggest is the predictability of returns. If an investor does not sell the bond prior to maturity, he/she does not have to worry about market fluctuations since the future value of the investment is known. How do you make money with a zero-coupon bond?

What Is a Zero-Coupon Bond? Definition, Advantages, Risks Advantages of zero-coupon bonds They often have higher interest rates than other bonds Since zero-coupon bonds do not provide regular interest payments, their issuers must find a way...

Zero coupon bond benefits

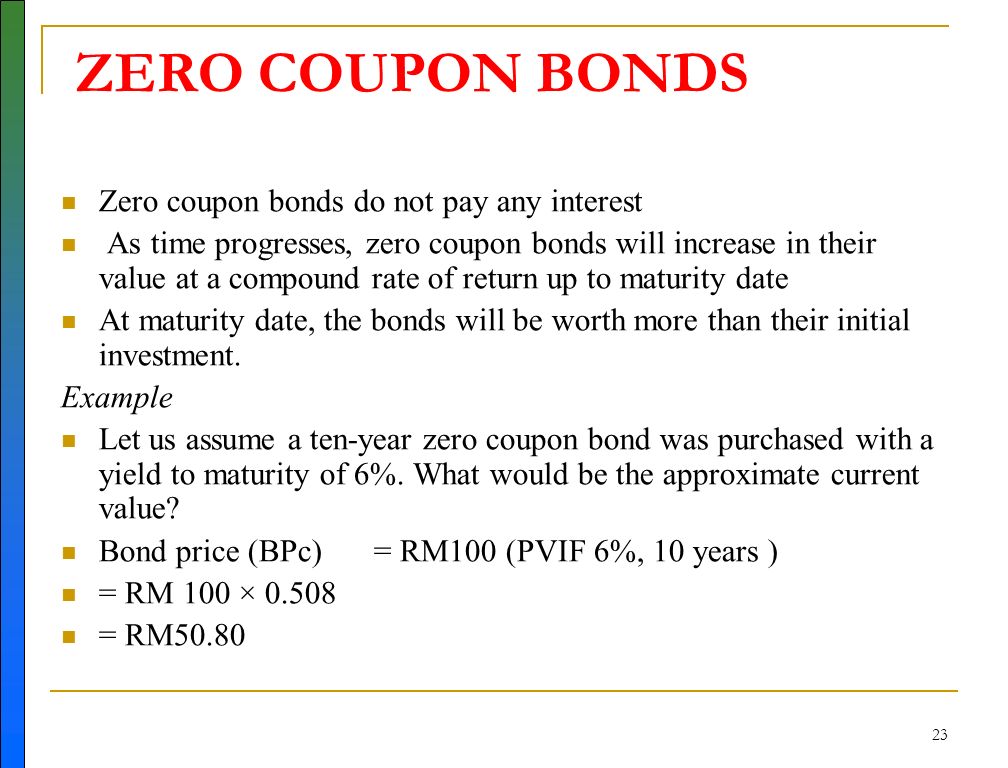

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right... The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

Zero coupon bond benefits. Home | NextAdvisor with TIME The I Bond Rate Just Fell Below 7%. We Answer Your Questions 7 min read. 4 Ways the Fed’s Interest Rate Hikes Directly Affect Your Money — and What You Can Do About It 9 min read. PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia Zero coupon bonds are a type of bonds that do not pay you periodic interest. It trades at a deep discount and is useful for investors who are not in the need for an interest income at a fixed interval. Your investment in zero coupon securities is safe. Also, the returns you earn in this type of bond can be beyond your expectation. Zero-Coupon Bond - Wall Street Prep Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. What are the benefits to the issuers of zero-coupon bonds? Answer: The biggest advantage of a zero-coupon bond is its predictability. If you do not sell the bond prior to maturity, you do not have to worry about market ups and downs since you know what your investment will be worth at a particular future date. Hey dears, We have the most profitable stoc... Zero Coupon Bonds - David Lerner Associates A husband and wife can each gift $14,000 for a total of $28,000, and this can continue to grow with the tax benefits of zero coupon municipal bonds. "Kiddie tax": A series of changes to the tax rules, starting in 1986, means that minors' accounts generating more than $2,000 in annual income for children under the age of 19 are taxed at the ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference...

Zero Coupon Bonds- Taxability Under Income Tax Act, 1961 - TaxWink Zero Coupon Bonds carries lesser risk with fixed income option. The return on these bonds is comparably higher as compared to other fixed income options. Further, the most important advantage of the zero coupon bonds is that no tax is payable on interest element if you invest in notified zero coupon bonds. What are the benefits to the issuers of zero-coupon bonds? This can benefit the issuer by encouraging a high volume of sales, which can generate substantial income. In addition to individual investors, secondary markets also trade in zero-coupon bonds ... How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond differs from regular bonds in that they do not pay income in the form of coupons. We explain how it works and where to invest in them. ... Zero coupon bonds don't offer the same benefits. Those bonds are issued at a deep discount and repay the par value at maturity. There is no coupon payment, hence the name. What is the difference between a zero-coupon bond and a ... The zero-coupon bond has no such cushion, faces higher risk, and makes more money if the issuer survives. Zero-Coupon Bonds and Taxes Zero-coupon bonds may also appeal to investors...

Answered: How will zero coupon bond benefit a… | bartleby Solution for How will zero coupon bond benefit a country

Zero-Coupon Bonds - Accounting Hub Advantages of Zero-Coupon Bonds. Zero-coupon bonds offer several benefits to issuers and investors. These bonds are less volatile and offer predictable returns to investors. Investors are assured of fixed income at maturity, so it eliminates the reinvestment risk as there are no periodic repayments. These bonds require a low initial investment.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero-Coupon Bonds can be highly beneficial if purchased when the interest rate is high. Purchasing municipal Zero-Coupon can be a great way to avoid tax since they are tax-free. However, this is applicable for investors living in the state where the bond has been issued. Zero-Coupon bonds come with both pros and cons.

U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · That means the impact could spread far beyond the agency’s payday lending rule. "The holding will call into question many other regulations that protect consumers with respect to credit cards, bank accounts, mortgage loans, debt collection, credit reports, and identity theft," tweeted Chris Peterson, a former enforcement attorney at the CFPB who is now a law professor at the University of Utah.

CBD Gummies | CBD Infused Gummies | 100% Vegan - CBDfx.com Enjoy our Berry Buzz THC Gummies for peak wellness benefits of full spectrum CBD, plus the deep “chill” vibe of delta-9 THC (5 mg per gummy). Want to step up your delta-9 experience? Try our high-potency Magic Melon THC Gummies, with a whopping 10 mg of delta-9 per serving.

Zero Coupon Bond Calculator – What is the Market Price ... What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Advantages of Zero-Coupon U.S. Treasury Bonds Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right...

Post a Comment for "41 zero coupon bond benefits"